|

Listen to this article

|

The John Deere 8R Autonomous Tractor was launched at CES 2022. | Credit: John Deere

John Deere has made another acquisition related to the development of autonomous tractors. John Deere has acquired numerous patents and other intellectual property from Light, which specializes in depth sensing and camera-based perception for autonomous vehicles. John Deere also hired a team of employees from Light. Financial terms of the deal are unknown.

Light was founded in 2013 and, according to Crunchbase, has raised $185.7 million. Its last funding round, a $121 Series D led by Softbank Vision Fund, came in July 2018, according to Crunchbase.

John Deere will integrate Light’s platform, Clarity, into its autonomous tractors. It appears John Deere is using a vision-only approach to autonomy here. Its new 8R autonomous tractor features six pairs of stereo cameras and doesn’t use LiDAR. While LiDAR has become commonplace for autonomous vehicles operating on roads, it appears to be less relevant for navigating a less hectic farm. John Deere also said the vision-based approach is better for identifying and monitoring weeds in real time.

Tesla uses an often-criticized, vision-only approach for its Autopilot Level 2 driving system. But on its website, Light says that “human-like vision is the key to enabling machines to navigate their environment accurately and safely.” Willy Pell, VP of autonomy and new ventures at Blue River Technology, a John Deere company, recently said on The Robot Report Podcast that LiDAR isn’t a good sensor option for autonomous tractors. The acquisition of Light would seem to back that up.

“There were a bunch of reasons [we chose not to use LiDAR], but dust was a major one. They just don’t perform as well in dust,” Pell said. “Another reason is that LiDARs have moving parts and we operate in really rugged environments. And the other reason is that we’re actually just not going that fast. We’re going 10 miles per hour, and we don’t have to see 90 meters ahead of us. We need to see 20 meters ahead of us. So we ended up with stereo cameras.”

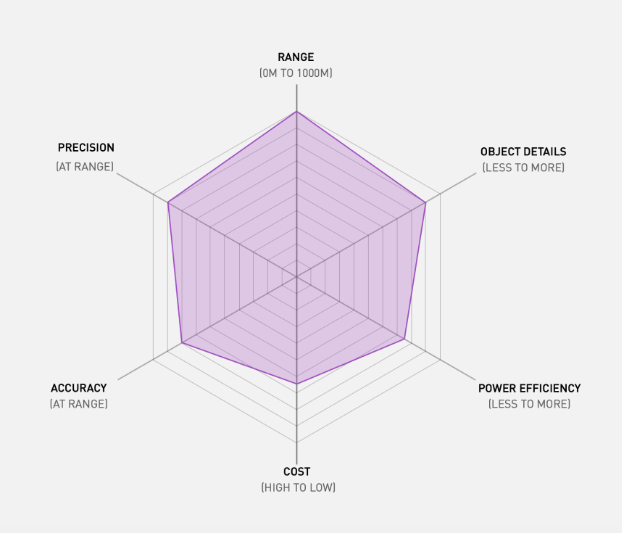

Light offers up this performance chart for its Clarity platform.

According to Light, its camera-based perception platform can see 3D structures at a range from 10 cm to 1000 m and captures 95 million points per second. It uses signal-processing to build a 3D view of the surrounding environment at 30 times a second.

Here is how Light describes its technology: “Light’s multi-camera depth perception platform improves upon existing stereo vision systems by using additional cameras, novel calibration, as well as unique signal processing to provide unprecedented depth quality across the camera field of view. With temporally consistent, full field of view depth that is intrinsically unified with the reference camera’s image at a pixel level, perception engineers are unshackled from the existing constraints of depth range, frequency, and even errors attributed to sensor fusion.”

John Deere making moves

This is the latest in a string of moves by John Deere. In April 2022, it formed a joint venture with GUSS Automation, a Kingsburg, California-based pioneer of semi-autonomous orchard and vineyard sprayers. Through the joint venture, Deere will help GUSS further collaborate with the Deere sales channel and GUSS will continue its innovation and product development to best serve customers, Davison said.

GUSS was founded in 2018 and has approximately 35 full-time employees. GUSS will retain its employees, brand name, and trademark, and continue to operate from its current location. GUSS employees, customers, and business partners should notice little change in daily operations resulting from the joint venture.

In August 2021, John Deere acquired Bear Flag Robotics for $250 million. Bear Flag Robotics is a Calif.-based developer of autonomous driving technology for tractors. Founded in 2017, Bear Flag Robotics retrofits its autonomy stack onto existing tractors. It uses cameras, LiDAR and radar technology for redundant, 360-degree situational awareness on a farm. The tractors can either be bought or rented under a robotics as a service (RaaS) agreement in which it charges per acre.

Of course, John Deere’s quest for autonomy was kicked off by its acquisition of Blue River Technology in 2017 for $305 million. Pell was recently a guest on The Robot Report Podcast to discuss how pivotal an acquisition this was for John Deere and how it resulted in the company’s autonomy as we know it today. You can listen to the interview below. It starts at the 27:02 mark of the episode.

Updated at 10:35 AM on May 20, 2022: John Deere has since clarified that it didn’t acquire all of Light.

The real cue as to why autonomous farm tractors are so special is that the tractor computer knows more about the soil in every field, meter by meter, than the farmer who has walked, and worked that field for 20 years. (Believe me, I walked and worked all of my Father’s fields for 10 years.) There is a special move for optimum production.