Although the COVID-19 pandemic began last year in Wuhan, China, it began slowing the global economy in earnest last month. As businesses and authorities scrambled to manage the fast-spreading virus, investments in robotics and related technologies continued, with more than $2.7 billion in reported transactions in March 2020.

The majority of that amount was investment in self-driving car company Waymo early in March, when the economic slowdown was just beginning in some countries and industries. The COVID-19 crisis has also provided opportunities for some providers of robots, autonomous vehicles, drones, and artificial intelligence.

Investment activity had already begun slowing in East Asia earlier this year, particularly in manufacturing center China, which is reportedly starting to recover. When Europe, North America, and the rest of the world pass the worst in terms of infections and shutdowns depends largely on local governments and remains to be seen.

The Robot Report tracked 29 investments in March 2020, compared with 43 worth $1.3 billion in March 2019 and 18 worth $1.9 billion in February 2020. The table below lists fundings in millions of U.S. dollars, where amounts were publicly available.

Robotics Investments, March 2020

| Company | Amt. (M$) | Type | Investor, acquirer, partner | Date | Technology |

|---|---|---|---|---|---|

| AirMap | 31.76 | investment | March 25 | drone mapping | |

| AIsing | 6.5 | Series B | Sparx Group, Dai-ichi Life Insurance | March 30 | AI |

| Altaeros Energies Inc. | investment | Mirai Creation Fund II | March 18 | autonomous aerostat | |

| Blickfield | Series A | Contineental Venture Capital, Wachstumsfonds Bayern | March 20 | lidar | |

| Bouffalo Lab | Series B | Sequoia Capital China | March 5 | AIoT chips | |

| CRP Robot | 14 | Series B | Shanghai Grand Yangtze Capital | March 6 | industrial automation |

| Dexai Robotics | 5.5 | seed | Hyperplane Venture Capital | March 5 | kitchen automation |

| Diligent Robotics Inc. | 10 | Series A | DNX Ventures | March 20 | hopital robot |

| Embodied Inc. | 9.6 | investment | Vulcan Capital | March 27 | AI, service robots |

| FiveAI Ltd. | 41 | Series B | Trustbridge Partners, Direct Line Group, Sistema VC | March 3 | autonomous vehicles |

| ForwardX | 14.95 | Series B+ | Hupan Licheng Fund | March 21 | mobile robots |

| Hailo | 60 | Series B | ABB Technology Ventures, NEC Corp., Latitude Ventures | March 5 | AI chips |

| Helm.ai Inc. | 13 | seed | A.Capital Ventures | March 25 | self-driving cars |

| Internest | pre-Series A | Boundary Holding | March 27 | drone guidance | |

| Keenon Robotics | 28.5 | Series B | Source Code Capital | March 9 | mobile service robots |

| Lilium | 240 | investment | Tencent | March 22 | autonomous air taxis |

| Mech-Mind Robotics Technologies Ltd. | 14 | Series B | Sequoia Capital China | March 2 | industrial automation |

| Neolix | 28.7 | Series A+ | Lixiang Automotive, Addor Capital, Yunqi Partners, Glory Ventures | March 8 | delivery robot |

| OrthoSpin Ltd. | 5 | Series B | Thee Trendlines Group, JJDC Inc. | March 31 | orthopedic treatment |

| RoboticsPlus.AI | 7.13 | Series A | Dragonrise Capital, Linear Venture Capital | March 24 | motion control |

| SFMap | 14 | Series A | Everest Venture Capital | March 25 | AI mapping |

| Shanghai Yitu Technology Co. | 30 | investment | CR Capital Management, China Chengtong Hong Kong | March 20 | AI |

| Silc Technologies Inc. | 12 | seed | Dell Capital | March 5 | machine vision |

| Skyports Ltd. | 0.796 | Series A | Irelandia Aviation | March 9 | drone delivery |

| SwarmFarm Robtics | 3.45 | investment | March 19 | autonomous tractors | |

| Teleo (Electronic Equipment and Instruments) | 0.15 | seed | Y Combinator | March 16 | mobile robots |

| TransEnterix Surgical Inc. | IPO | Ladenburg Thalmann & Co. | March 5 | surgical | |

| Waymo | 2250 | investment | Silver Lake, CPP Investments, Mubadala Investment Co. | March 2 | autonomous vehicles |

March 2020 mergers and failures

Just as the number of reported robotics investments started to drop, so too have mergers and acquisitions. There was only one in March 2020, compared with six in February and 16 a year ago.

Yokogawa Electric Corp. bought Danish AI and machine vision firm Grazper Technologies for an unspecified amount.

Even though there has been a sharp rise in U.S. unemployment, some executives are already looking ahead to resuming mergers and acquisitions, according to PitchBook.

In the meantime, two robotics companies shut down in March 2020 because they ran out of funding, not because they might have been considered “non-essential” businesses. San Francisco-based autonomous truck startup Starsky Robotics and Malden, Mass.-based hybrid drone power-supply provider Top Flight Technologies Inc. closed.

Stefan Seltz-Axmacher, co-founder and former CEO of Starsky Robotics blamed impatient investors and “non-sexy” AI development for the failure, but other self-driving vehicle companies are continuing to work on systems for delivery and carrying passengers. Sources confirmed that Top Flight Technologies has released its employees and is looking to sell its intellectual property.

Self-driving vehicles keep on rolling, flying

As mentioned above, Alphabet Inc. unit Waymo LLC raised $2.25 billion in its first external round. The Mountain View, Calif.-based self-driving car company said it plans to continue investing in people and technologies around its Waymo Driver product.

Munich, Germany-based Lilium raised $240 million in March 2020 to build and operate an autonomous air taxi. London-based Skyports Ltd. raised $796,000 in Series A funding to acquire “vertiports” and bring its urban and rural drone-delivery services to market.

Altaeros Energies Inc. in Somerville, Mass., said it has received an unspecified investment for its autonomous aerostat platforms for bringing broadband Internet to rural communities.

Back on the ground, London-based FiveAI Ltd. raised Series B funding of $41 million to commercialize its autonomy algorithms and cloud-based processing platform. Helm.ai Inc. in Menlo Park, Calif., received seed investment of $13 million to develop its deep-learning systems for self-driving cars.

On the supply chain side, Beijing-based Neolix raised $28.7 million to meet demand for its driverless delivery robot.

Component companies collect funding in March 2020

While autonomous vehicles have received the lion’s share of funding lately, the past month was a good one for companies supplying sensors, processors, and programming for such vehicles and robotics.

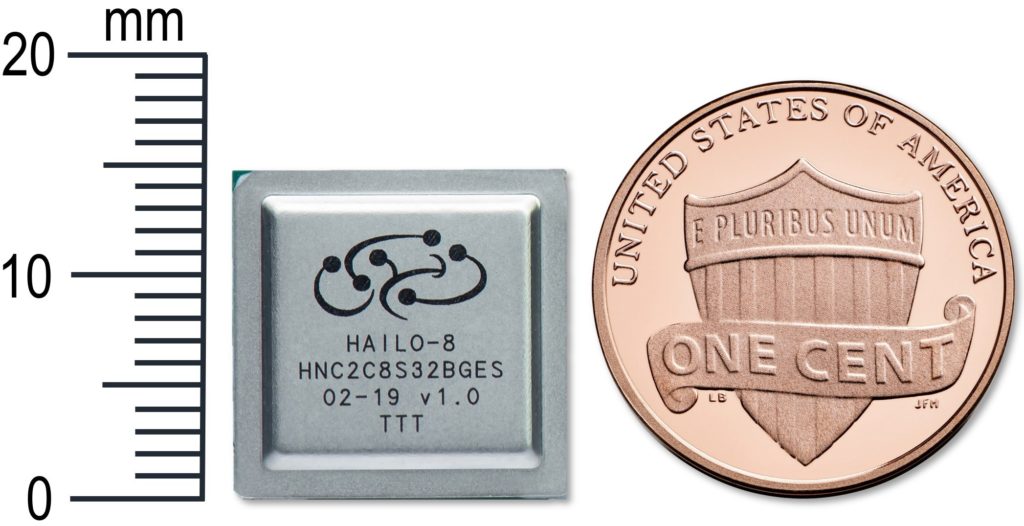

ABB Technology Ventures, NEC Corp., and Latitude Ventures participated the $60 million Series B investment in Hailo in Tel Aviv, Israel. The company is working on a neural network processor for edge devices such as robots.

Hailo-8 deep learning chip, to scale. Source: Hailo

Shanghai, China-based Yitu Technology Co. raised $30 million as it applies AI to machine vision, voice interfaces, and comprehension.

SiLC Technologies Inc. in Monrovia, Calif., closed a $12 million seed round in March 2020. The company is working on its 4D+ Vision Chip, which it claimed is the industry’s first fully integrated frequency modulated continuous wave (FMCW) silicon photonic platform.

Japan’s AIsing raised $6.5 million in Series B funding to advance its Algorithm Development Group, which is working on edge AI software. Pudong, China-based Buffalo Lab raised “tens of millions of dollars” for its “AIoT” ultra-low-power chips in a Series B round, reported DealStreet Asia.

As these investments demonstrate, pushing processing to the edge is becoming a popular way of pre-processing data for compute in the cloud. The effect of 5G networks on the Industrial Internet of Things (IIoT) and AI could accelerate this approach.

Munich-based lidar sensor maker Blickfield raised an unspecified amount of Series A funding.

Industrial and service robots see smaller growth

Reflecting the slowdown in manufacturing, two Chinese companies raised over 100 million yuan ($14 million) each in the only investment activity in that sector this past month. Beijing-based Mech-Mind Robotics Technology obtained Series B financing for its robots for bin picking and machine tending.

Chengdu-based CRP Robot raised Series B funding as it continues its expansion from robot controllers to robots for welding, stamping, and materials handling.

Slowdowns vary considerably by region. “In Mexico, automotive manufacturing is not viewed as essential, as in the U.S. and Canada,” noted Mike Cicco, president and CEO of FANUC America, during an Association for Advancing Automation (A3) webinar today. “Other industries are still producing goods.”

Gindie, Australia-based SwarmFarm Robotics raised 6 million Australian dollars ($3.45 million U.S.) to grow its global ambitions for its agricultural robots. It has sold six units so far.

Shanghai-based Keenon Robotics Co., whose Peanut mobile robots are among those being used to deliver food and minimize human contact during the novel coronavirus pandemic, received $28.5 million in a Series B round.

Beijing-based ForwardX said it raised $14.9 million in Series B+ funding for its vision-guided autonomous mobile robots (AMRs) for warehouses.

Like Miso Robotics Inc., which opened its crowdfunding campaign for kitchen automation this week, Somerville, Mass.-based Dexai Robotics announced an “oversubscribed $5.5 million seed round” for its food-preparation robot. Such robots are expected to be in high demand, as hygiene and labor concerns rise.

Healthcare and service robot firms expect growth

In March 2020, there were not many healthcare robotics transactions, but that could change in the near future with shortages of trained personnel and the need for “social distancing.”

Austin, Texas-based Diligent Robotics, which has been working on the Moxi mobile manipulator, raised $10 million in Series A funding. Meanwhile, OrthoSpin Ltd. in Misgav, Israel, raised $5 million for its robotic orthopedic treatment system.

TransEnterix Surgical Inc. announced an initial public offering. The company in Research Triangle Park, N.C., has developed the Senhance robotic surgical system. Its Intelligent Surgical Unit for machine vision guidance received FDA approval in March 2020.

Automakers and other manufacturers are switching over production lines to fill shortages of personal protective equipment, ventilators, and other healthcare technologies, and many industry experts expect both awareness and investments to continue beyond the COVID-19 crisis.

“There’s a real opportunity [for the public to see] robots at the forefront, doing great things,” said Milton Guerry, president of Schunk USA and of the International Federation of Robotics, during the A3 webcast. “So many things are disrupted right now, but the most successful companies will take a good look at automation.”

Editors’ note: What defines robotics investments? The answer to this simple question is central in any attempt to quantify them with some degree of rigor. To make investment analyses consistent, repeatable, and valuable, it is critical to wring out as much subjectivity as possible during the evaluation process. This begins with a definition of terms and a description of assumptions.

Investors and investing

Investment should come from venture capital firms, corporate investment groups, angel investors, and other sources. Friends-and-family investments, government/non-governmental agency grants, and crowd-sourced funding are excluded.

Robotics and intelligent systems companies

Robotics companies must generate or expect to generate revenue from the production of robotics products (that sense, analyze, and act in the physical world), hardware or software subsystems and enabling technologies for robots, or services supporting robotics devices. For this analysis, autonomous vehicles (including technologies that support autonomous driving) and drones are considered robots, while 3D printers, CNC systems, and various types of “hard” automation are not.

Companies that are “robotic” in name only, or use the term “robot” to describe products and services that that do not enable or support devices acting in the physical world, are excluded. For example, this includes “software robots” and robotic process automation. Many firms have multiple locations in different countries. Company locations given in the analysis are based on the publicly listed headquarters in legal documents, press releases, etc.

Verification

Funding information is collected from a number of public and private sources. These include press releases from corporations and investment groups, corporate briefings, industry analysts such as PitchBook, and association and industry publications. In addition, information comes from sessions at conferences and seminars, as well as during private interviews with industry representatives, investors, and others. Unverifiable investments are excluded.

Tell Us What You Think!